-

Support Manulife MPF as we pursue an incredible 8 year winning streak* in the “People’s Choice” Award and capture the “Employers’ Choice” Award!

👉 People’s Choice: https://mpfratings.com.hk/2026-peoples-choice-award-voting/

👉 Employers’ Choice: https://mpfratings.com.hk/services/2026-mpf-awards/2026-employers-choice-voting-form/

Cast your vote by 31 Jan and help us reach new heights!

*Source: MPF Ratings. Manulife (International) Limited has been voted by the public as “People’s Choice” for the 7th consecutive year (from 2019 to 2025). For details, please visit: https://mpfratings.com.hk/2025/02/28/13th-edition-of-the-mpf-awards-sees-an-mpfs-3-peat/

-

Enjoy bonus unit rebates^ while saving more for retirement and paying less tax!

Act Now: https://portal.empf.org.hk/login

User Guide: https://youtu.be/GNN1MFEZ740

Contact your Manulife MPF Intermediary to learn more!

Offer period: January 1 to March 31, 2026 (both dates inclusive)

^Terms and conditions apply. For details, please refer to the leaflet.

* Please note that sharing this post shall be considered as carrying on regulated activities defined under the Mandatory Provident Fund Schemes Ordinance (“MPFSO”) and you should comply with the relevant statutory requirements imposed by the MPFA and the internal rules imposed by MIL -

A brand-new platform means a brand-new experience. The “Chat eMPF” video series reveals useful information and tips to help you transition smoothly to the eMPF Platform (“eMPF”).

This video shares three key tips:

• Carefully review the eMPF communication pack sent by Manulife: including those important details you don’t want to miss!

• How to register for eMPF in just 3 easy steps

• Why it's important to update your personal information

Manulife Global Select (MPF) Scheme (“Scheme“) is targeted to onboard eMPF on 6 November this year*. As a Scheme member, watch the video now and get prepared!

Watch the video now: https://youtu.be/5_nX3R6iu6I

Register now to join the eMPF introductory webinars:

https://www.manulife.com.hk/en/individual/products/mpf/empf-platform/empf-webinars.html

Visit Manulife eMPF Hub page: www.manulife.com.hk/empf-en

For enquiries about joining eMPF, don't hesitate to contact your MPF intermediary.

Remark: *The date of onboarding to eMPF is subject to a legal notice to be published in the Gazette of the Government of the Hong Kong Special Administrative Region. In case of a subsequent adjustment, we will promptly communicate this to you.

Maurice is a virtual avatar developed based on the likeness and voice of Maurice Aw-Yong, a real employee of Manulife.

Investment involves risks. Before making any investment choices, you should consider the scope and the service level offered by the scheme trustee and relevant service provider, whether fund choices are sufficient enough and suit your investment needs, and the related fees and charges. You should also consider your own risk tolerance level and financial circumstances. Investment loss or gain may be incurred when transferring accrued benefits to/from other provider(s). Please refer to the MPF Scheme Brochure and Key Scheme Information Document for details including risk factors, fees and charges of the scheme.

This video is the property of Manulife (International) Limited (“Manulife”). Unless otherwise indicated, the materials and information in this video may not be altered, reproduced, disseminated or distributed in any format without prior permission from Manulife. Manulife may change the content of this video from time to time without giving any prior notice. This video is for general reference only. It does not constitute an offer to see or a solicitation of an offer to buy any products or services from Manulife or any of its affiliated companies. This video is not intended to give any kind of financial, insurance, legal, accounting or taxation advice and shall not be based upon as any kind of such advice.

Issued by Manulife (International) Limited (Incorporated in Bermuda with limited)

-

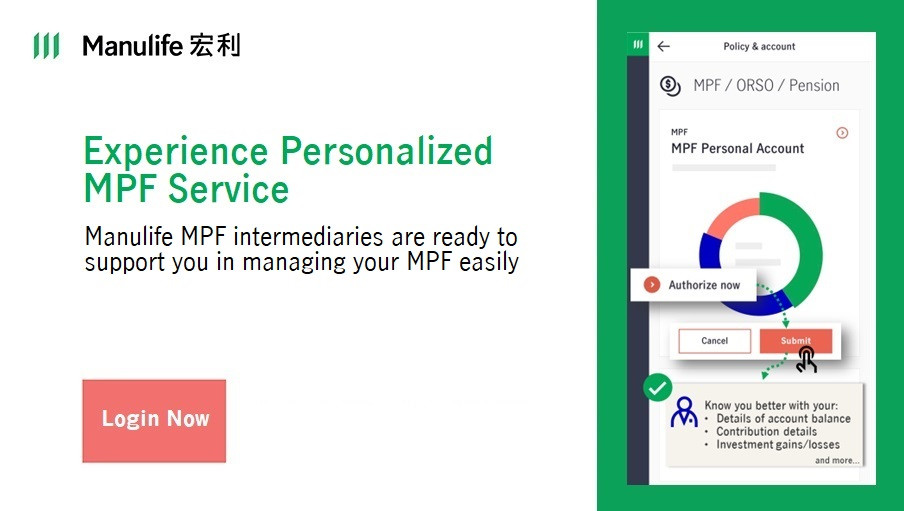

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

-

With the Manulife Hong Kong mobile app, you can now browse featured market insights which cover MPF education series, market outlook and investment notes. No matter the time and place, you can now easily stay close to market trends, understand global investment trends, and be ahead in seizing your next investment opportunity.

To browse the latest "Featured insights", simply tap on the shortcut on the homepage. You can also tap on "For you" at the bottom of the homepage and choose "Featured insights".

My Favourite

My Favourite

Search

Search