-

Follow up treatment by Chinese medicine practitioner covered up to HK$3,000!

The above general insurance product ("Product") is underwritten by QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") which is authorised and regulated in Hong Kong by the Insurance Authority ("IA"), and is only applicable to licensed individual insurance agents of Manulife (International) Limited (incorporated in Bermuda with limited liability), who have also registered as licensed individual insurance agents appointed by QBE Hong Kong.

In case of disputes, please contact QBE Hong Kong directly. QBE Hong Kong reserves the right to make the final decision and modify or terminate the above promotion offers.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document.

COVID-19 Protection Coverage FAQ : Please click here

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Follow up treatment by Chinese medicine practitioner covered up to HK$3,000!

The above general insurance product ("Product") is underwritten by QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") which is authorised and regulated in Hong Kong by the Insurance Authority ("IA"), and is only applicable to licensed individual insurance agents of Manulife (International) Limited (incorporated in Bermuda with limited liability), who have also registered as licensed individual insurance agents appointed by QBE Hong Kong.

In case of disputes, please contact QBE Hong Kong directly. QBE Hong Kong reserves the right to make the final decision and modify or terminate the above promotion offers.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document.

COVID-19 Protection Coverage FAQ : Please click here

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

How do you plan to use your bonus this year? Have you thought about saving up for your retirement by making MPF Tax Deductible Voluntary Contributions (TVC)^?

TVC offers flexible contribution arrangements, allowing clients to make contributions and adjust the contribution amount anytime.

• Contributions can be made on a monthly or lump sum basis*

• Contribution amount and frequency can be adjusted at your own choice*

^The account balance can only be withdrawn upon members reaching age 65 or on statutory grounds under the MPF legislation.

*Subject to the rules of the MPF scheme.

Help clients set up a TVC account and make contributions anytime, anywhere through BuySimple, so they can put their retirement plans in action.

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

How do you plan to use your bonus this year? Have you thought about saving up for your retirement by making MPF Tax Deductible Voluntary Contributions (TVC)^?

TVC offers flexible contribution arrangements, allowing clients to make contributions and adjust the contribution amount anytime.

• Contributions can be made on a monthly or lump sum basis*

• Contribution amount and frequency can be adjusted at your own choice*

^The account balance can only be withdrawn upon members reaching age 65 or on statutory grounds under the MPF legislation.

*Subject to the rules of the MPF scheme.

Help clients set up a TVC account and make contributions anytime, anywhere through BuySimple, so they can put their retirement plans in action.

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

With FlexiFortune Annuity Plan, you will enjoy the financial confidence of knowing that your future goals will be empowered by a regular monthly income for up to 25 years. You will have the flexibility to start the monthly income in the next policy year after your plan is paid up or defer it to another time to suit your needs. The plan also comes with the added protection of a dementia care booster that provides an additional benefit of up to 100% of your guaranteed monthly income in case severe dementia is diagnosed.

• Flexible financial planning

• A stable income stream to support your goals

• Flexibility to change the income start year

• 2 annuity options to protect your loved ones

• Dementia care booster for added peace of mind

• Easy application process

Please click on the link to see product leaflet for details.The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

BuySimple.hk provides customers with a convenient and fast self-service online application platform.

With just a few steps, your customers can submit a TVC account application and make contributions to it.

Share with your customers now so they can experience this easy application process!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

BuySimple.hk provides customers with a convenient and fast self-service online application platform.

With just a few steps, your customers can submit a TVC account application and make contributions to it.

Share with your customers now so they can experience this easy application process!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

BuySimple.hk provides customers with a convenient and fast self-service online application platform.

With just a few steps, your customers can submit a TVC account application and make contributions to it.

Share with your customers now so they can experience this easy application process!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

BuySimple.hk provides customers with a convenient and fast self-service online application platform.

With just a few steps, your customers can submit a TVC account application and make contributions to it.

Share with your customers now so they can experience this easy application process!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

With our Holistic ‘Medical Professional Support Service’*, you can get health information through calling our Healthcare Hotline and enjoy the dedicated support from our Personalized Medical Case Manager upon cancer diagnosis or before designated surgeries.

*The service is available to insured persons of designated medical plans. Terms & conditions of Holistic ‘Medical Professional Support Service’ apply.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product.

With our Holistic ‘Medical Professional Support Service’*, you can get health information through calling our Healthcare Hotline and enjoy the dedicated support from our Personalized Medical Case Manager upon cancer diagnosis or before designated surgeries.

*The service is available to insured persons of designated medical plans. Terms & conditions of Holistic ‘Medical Professional Support Service’ apply.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product.

Thank you for your ongoing trust and support in us. We are pleased to share with you that Manulife Hong Kong enters Campaign Asia-Pacific’s top 100 brands list for Hong Kong and ranks No. 94 in 2018, 35 spots higher than last year. What’s more, we are the only insurance brand on the list!

We will continue to offer comprehensive and diversified insurance and financial solutions, as well as professional services as a token of appreciation for your support.

Thank you for your ongoing trust and support in us. We are pleased to share with you that Manulife Hong Kong enters Campaign Asia-Pacific’s top 100 brands list for Hong Kong and ranks No. 94 in 2018, 35 spots higher than last year. What’s more, we are the only insurance brand on the list!

We will continue to offer comprehensive and diversified insurance and financial solutions, as well as professional services as a token of appreciation for your support.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Brand new feature for our Investment-linked Assurance Scheme holders: You can easily recall your online instruction for switching investment choices or changing future allocation by 3pm within the same day# via our customer website* at will.

Remarks:

# Instruction submitted online at or before 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the same business day.

Instruction submitted online after 3:00 p.m. Hong Kong time on a business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

Instruction submitted online on a non-business day can be cancelled online at or before 3:00 p.m. Hong Kong time on the next business day.

*Online instruction for switching investment choices or changing future allocation for Investment-linked Assurance Schemes can only be cancelled via our customer website.

Burst pipes can be a homeowner's worst nightmare.

Not only is your home flooded, the water might leak and damage your neighbor’s home as well.

Get covered for third-party liability protection of up to HK$10,000,000!

1.The above general insurance product ("Product") is underwritten by QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") which is authorised and regulated in Hong Kong by the Insurance Authority ("IA"), and is only applicable to licensed individual insurance agents of Manulife (International) Limited (incorporated in Bermuda with limited liability), who have also registered as licensed individual insurance agents appointed by QBE Hong Kong.

2.In case of disputes, please contact QBE Hong Kong directly. QBE Hong Kong reserves the right to make the final decision and modify or terminate the above promotion offers.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document.

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Burst pipes can be a homeowner's worst nightmare.

Not only is your home flooded, the water might leak and damage your neighbor’s home as well.

Get covered for third-party liability protection of up to HK$10,000,000!

1.The above general insurance product ("Product") is underwritten by QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") which is authorised and regulated in Hong Kong by the Insurance Authority ("IA"), and is only applicable to licensed individual insurance agents of Manulife (International) Limited (incorporated in Bermuda with limited liability), who have also registered as licensed individual insurance agents appointed by QBE Hong Kong.

2.In case of disputes, please contact QBE Hong Kong directly. QBE Hong Kong reserves the right to make the final decision and modify or terminate the above promotion offers.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document.

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Burst pipes can be a homeowner's worst nightmare.

Not only is your home flooded, the water might leak and damage your neighbor’s home as well.

Get covered for third-party liability protection of up to HK$10,000,000!

1.The above general insurance product ("Product") is underwritten by QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") which is authorised and regulated in Hong Kong by the Insurance Authority ("IA"), and is only applicable to licensed individual insurance agents of Manulife (International) Limited (incorporated in Bermuda with limited liability), who have also registered as licensed individual insurance agents appointed by QBE Hong Kong.

2.In case of disputes, please contact QBE Hong Kong directly. QBE Hong Kong reserves the right to make the final decision and modify or terminate the above promotion offers.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document.

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Burst pipes can be a homeowner's worst nightmare.

Not only is your home flooded, the water might leak and damage your neighbor’s home as well.

Get covered for third-party liability protection of up to HK$10,000,000!

1.The above general insurance product ("Product") is underwritten by QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") which is authorised and regulated in Hong Kong by the Insurance Authority ("IA"), and is only applicable to licensed individual insurance agents of Manulife (International) Limited (incorporated in Bermuda with limited liability), who have also registered as licensed individual insurance agents appointed by QBE Hong Kong.

2.In case of disputes, please contact QBE Hong Kong directly. QBE Hong Kong reserves the right to make the final decision and modify or terminate the above promotion offers.

The content on this post is provided for general information purposes only and does not take account of your individual needs and circumstances. It should not be construed as an insurance advice and does not constitute any offer or any solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document.

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

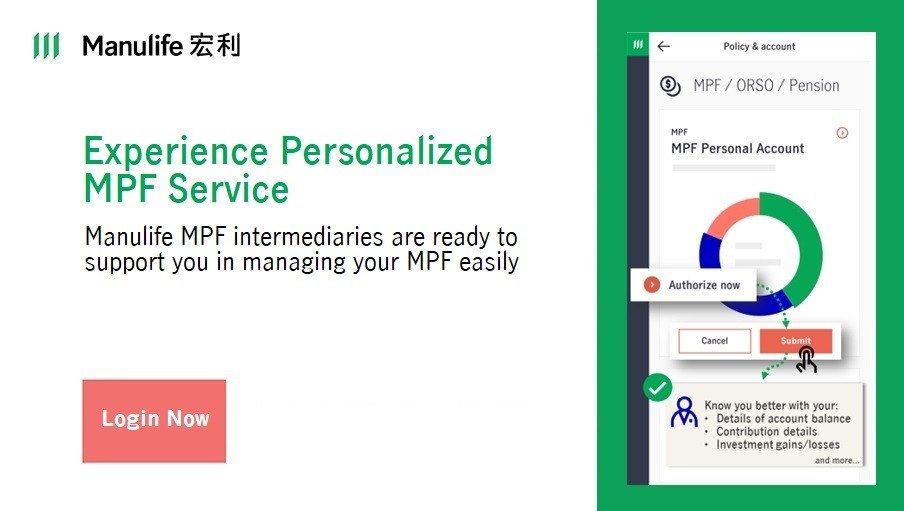

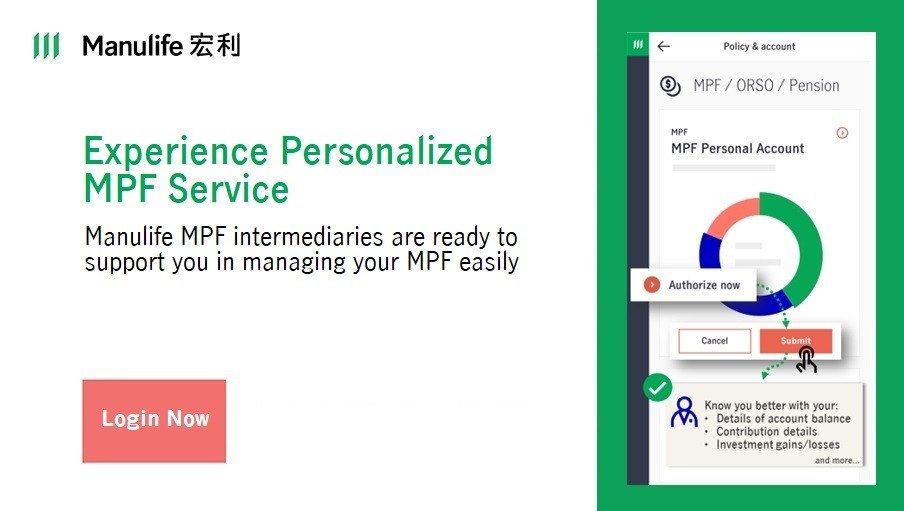

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Manulife Bright Care PRO is designed to offer the life insured well-rounded protection against up to 123 critical illnesses and diseases until the age of 100, with extra protection against cancer, heart attack (myocardial infarction) and stroke. In case a late stage cancer is diagnosed, we will provide extra financial support to enable the life insured to access cancer treatments/surgical procedures overseas or off-label/clinical trial cancer drugs.

At the same time, you can also purchase the plan for your children to protect them against critical illnesses, plus 19 juvenile diseases that include Autism, Attention Deficit / Hyperactivity Disorder (ADHD) and Tourette Syndrome. It also comes with a parental compassionate premium waiver as added financial support.

• Well-rounded protection at a guaranteed premium

• Up to 123 critical illnesses and diseases covered

• 2 tiers of protection for stays in Intensive Care Units (ICU)

• Multiple coverages for cancer, heart attack and stroke

• Extra financial support for overseas or non-conventional treatment for late stage cancer

• Continuous protection to safeguard your child

Please click on the link to see product leaflet for details.

The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

Manulife Bright Care PRO is designed to offer the life insured well-rounded protection against up to 123 critical illnesses and diseases until the age of 100, with extra protection against cancer, heart attack (myocardial infarction) and stroke. In case a late stage cancer is diagnosed, we will provide extra financial support to enable the life insured to access cancer treatments/surgical procedures overseas or off-label/clinical trial cancer drugs.

At the same time, you can also purchase the plan for your children to protect them against critical illnesses, plus 19 juvenile diseases that include Autism, Attention Deficit / Hyperactivity Disorder (ADHD) and Tourette Syndrome. It also comes with a parental compassionate premium waiver as added financial support.

• Well-rounded protection at a guaranteed premium

• Up to 123 critical illnesses and diseases covered

• 2 tiers of protection for stays in Intensive Care Units (ICU)

• Multiple coverages for cancer, heart attack and stroke

• Extra financial support for overseas or non-conventional treatment for late stage cancer

• Continuous protection to safeguard your child

Please click on the link to see product leaflet for details.

The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

Manulife Bright Care PRO is designed to offer the life insured well-rounded protection against up to 123 critical illnesses and diseases until the age of 100, with extra protection against cancer, heart attack (myocardial infarction) and stroke. In case a late stage cancer is diagnosed, we will provide extra financial support to enable the life insured to access cancer treatments/surgical procedures overseas or off-label/clinical trial cancer drugs.

At the same time, you can also purchase the plan for your children to protect them against critical illnesses, plus 19 juvenile diseases that include Autism, Attention Deficit / Hyperactivity Disorder (ADHD) and Tourette Syndrome. It also comes with a parental compassionate premium waiver as added financial support.

• Well-rounded protection at a guaranteed premium

• Up to 123 critical illnesses and diseases covered

• 2 tiers of protection for stays in Intensive Care Units (ICU)

• Multiple coverages for cancer, heart attack and stroke

• Extra financial support for overseas or non-conventional treatment for late stage cancer

• Continuous protection to safeguard your child

Please click on the link to see product leaflet for details.

The content on this post is provided for general information purpose only and does not take account of your individual needs and circumstances. It should not be construed as insurance advice and does not constitute any offer, solicitation to offer or a recommendation of any insurance product. Such general information does not contain full terms of the policy, and the full terms can be found in the policy document. Please refer to the relevant product leaflet for product features and risks.

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

To help you better manage the ILAS (Investment-linked Assurance Scheme) investment choices, we not only enhanced the interface of the Manulife customer website, but we have also added new features to the Manulife HK mobile app. You can now switch your investment choices and change your future allocation instructions anytime and anywhere, allowing you to enjoy an even more convenient experience.

With a few simple steps, you can easily switch the existing investment choices through the Manulife HK mobile app.

Download the Manulife HK mobile app now, you can now manage the investment choices of your ILAS policy even more convenient.

To help you better manage the ILAS (Investment-linked Assurance Scheme) investment choices, we not only enhanced the interface of the Manulife customer website, but we have also added new features to the Manulife HK mobile app. You can now switch your investment choices and change your future allocation instructions anytime and anywhere, allowing you to enjoy an even more convenient experience.

With a few simple steps, you can easily switch the existing investment choices through the Manulife HK mobile app.

Download the Manulife HK mobile app now, you can now manage the investment choices of your ILAS policy even more convenient.

To help you better manage the ILAS (Investment-linked Assurance Scheme) investment choices, we not only enhanced the interface of the Manulife customer website, but we have also added new features to the Manulife HK mobile app. You can now switch your investment choices and change your future allocation instructions anytime and anywhere, allowing you to enjoy an even more convenient experience.

With a few simple steps, you can easily switch the existing investment choices through the Manulife HK mobile app.

Download the Manulife HK mobile app now, you can now manage the investment choices of your ILAS policy even more convenient.

How do you plan to use your bonus this year? Have you thought about saving up for your retirement by making MPF Tax Deductible Voluntary Contributions (TVC)^?

TVC offers flexible contribution arrangements, allowing clients to make contributions and adjust the contribution amount anytime.

• Contributions can be made on a monthly or lump sum basis*

• Contribution amount and frequency can be adjusted at your own choice*

^The account balance can only be withdrawn upon members reaching age 65 or on statutory grounds under the MPF legislation.

*Subject to the rules of the MPF scheme.

Help clients set up a TVC account and make contributions anytime, anywhere through BuySimple, so they can put their retirement plans in action.

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

How do you plan to use your bonus this year? Have you thought about saving up for your retirement by making MPF Tax Deductible Voluntary Contributions (TVC)^?