-

A brand-new platform means a brand-new experience. The “Chat eMPF” video series reveals useful information and tips to help you transition smoothly to the eMPF Platform (“eMPF”).

This video shares three key tips:

• Carefully review the eMPF communication pack sent by Manulife: including those important details you don’t want to miss!

• How to register for eMPF in just 3 easy steps

• Why it's important to update your personal information

Manulife Global Select (MPF) Scheme (“Scheme“) is targeted to onboard eMPF on 6 November this year*. As a Scheme member, watch the video now and get prepared!

Watch the video now: https://youtu.be/5_nX3R6iu6I

Register now to join the eMPF introductory webinars:

https://www.manulife.com.hk/en/individual/products/mpf/empf-platform/empf-webinars.html

Visit Manulife eMPF Hub page: www.manulife.com.hk/empf-en

For enquiries about joining eMPF, don't hesitate to contact your MPF intermediary.

Remark: *The date of onboarding to eMPF is subject to a legal notice to be published in the Gazette of the Government of the Hong Kong Special Administrative Region. In case of a subsequent adjustment, we will promptly communicate this to you.

Maurice is a virtual avatar developed based on the likeness and voice of Maurice Aw-Yong, a real employee of Manulife.

Investment involves risks. Before making any investment choices, you should consider the scope and the service level offered by the scheme trustee and relevant service provider, whether fund choices are sufficient enough and suit your investment needs, and the related fees and charges. You should also consider your own risk tolerance level and financial circumstances. Investment loss or gain may be incurred when transferring accrued benefits to/from other provider(s). Please refer to the MPF Scheme Brochure and Key Scheme Information Document for details including risk factors, fees and charges of the scheme.

This video is the property of Manulife (International) Limited (“Manulife”). Unless otherwise indicated, the materials and information in this video may not be altered, reproduced, disseminated or distributed in any format without prior permission from Manulife. Manulife may change the content of this video from time to time without giving any prior notice. This video is for general reference only. It does not constitute an offer to see or a solicitation of an offer to buy any products or services from Manulife or any of its affiliated companies. This video is not intended to give any kind of financial, insurance, legal, accounting or taxation advice and shall not be based upon as any kind of such advice.

Issued by Manulife (International) Limited (Incorporated in Bermuda with limited)

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

From 1 Sep to 31 Oct 2025 (Promotion Period), simply follow these two steps to participate in the Golden Summer Lucky Draw for a chance to win the grand prize — a 5-tael 999.9 gold — or other amazing rewards, with total prizes valued over HK$400,000!

Steps:

1. Register your eMPF account and hold a valid eMPF ID (If you have already registered with eMPF earlier, you do not need to register again); and

2. Complete the risk profile questionnaire and successfully register on the Lucky Draw campaign site

Click here to participate now!

How to register eMPF?: eMPF Registration | eMPF Website

*The Lucky Draw is subject to terms and conditions.

Trade Promotion Competition Licence No.: 60448

WhatsApp/WeChat is the third-party service platform which is not operated by Manulife. Please do not disclose any sensitive and personal information to any third-party platform.

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

To enable us to provide personalized MPF services more effectively, existing customers can choose to authorize Manulife to release your MPF account information to your MPF intermediary, including but not limited to:

- Details of account balance

- Contribution details

- Investment gains/losses

Simply submit an authorization request to allow your MPF intermediary knows more about your account, such that they can provide appropriate market information and updates in the future, as well as engage in further discussions and portfolio reviews!

Login now to Customer Website or mobile app to submit your authorization request!

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

With the Manulife Hong Kong mobile app, you can now browse featured market insights which cover MPF education series, market outlook and investment notes. No matter the time and place, you can now easily stay close to market trends, understand global investment trends, and be ahead in seizing your next investment opportunity.

To browse the latest "Featured insights", simply tap on the shortcut on the homepage. You can also tap on "For you" at the bottom of the homepage and choose "Featured insights".

From now on, MPF members can browse and e- redeem our exclusive MPF offers to members through the “Manulife HK” Mobile app anytime, anywhere.

Download the “Manulife HK” Mobile app and register your account, you can now to manage your accounts faster and easier than ever.

Since you are not a registered MPF intermediary, the content cannot be shared with your customers.Share to:

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

Remarks: Share to WhatsApp function is only applicable to mobile and desktop versions, not to web version

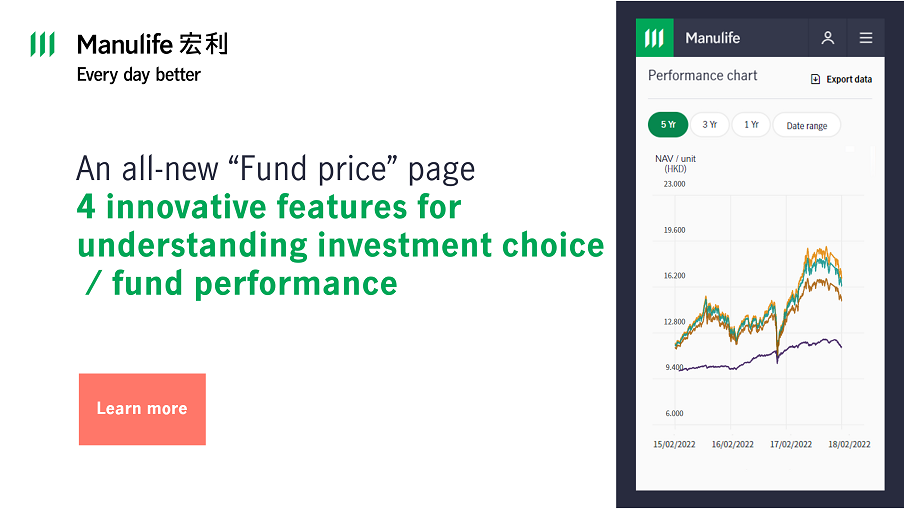

Manulife has launched an all-new "Fund price" page to help you better understand different investment choice / fund performance.

1. Responsive design

The interface adapts to different screen sizes including computers, tablets and smartphones. You can easily check the price of investment choice / fund and information anytime, anywhere.

2. An all-new interface with searching and filtering functions

Clearly shows the latest price and performance of investment choice / fund with searching and filtering functions to help you quickly obtain the information you need.

3. Enhanced comparison function for investment choice / fund

To let you analyze or compare the charts and data of up to 5 investment choices / funds in one go.

4. A more comprehensive investment choice / fund details page

To give you more detailed information such as top holdings of underlying fund / investment choice* and portfolio allocation#.

*Top holdings of underlying fund / investment choice (Applicable to specific investment-linked assurance schemes)

#Portfolio allocation (Applicable to MPF and ORSO schemes)

With your needs in mind, we have added the following new functions to the MPF account management page of Manulife customer website and the Manulife HK Mobile App, so as to bring you an even better MPF management experience!

1. Contribution/asset transfer-in record - Brand new “filter” function

- Helps you better understand the status of your account by enabling you to filter the records of your contributions/transferred-in assets allocated in the past 24 months

2. e-Statement/ e-Notice - Clean and neat layout

- The new layout allows you to easily view all e-Statements and e-Notices under your every MPF account at a glance.

3. More functions simultaneously added to the “Manulife HK’ Mobile App

- Opt for and check MPF e-Statements/ e-Notices and update your contact information right away anywhere, anytime.

Manulife has launched an all-new MPF account management section in customer website. With a more easy-to-use interface and your portfolio at a glance, managing your account has never been simpler.

The new ‘biometric authentication’* function has also landed on the mobile app for even smoother login!

*including ‘face recognition’ and ‘fingerprint authentication’

-

A brand-new platform means a brand-new experience. The “Chat eMPF” video series reveals useful information and tips to help you transition smoothly to the eMPF Platform (“eMPF”).

This video shares three key tips:

• Carefully review the eMPF communication pack sent by Manulife: including those important details you don’t want to miss!

• How to register for eMPF in just 3 easy steps

• Why it's important to update your personal information

Manulife Global Select (MPF) Scheme (“Scheme“) is targeted to onboard eMPF on 6 November this year*. As a Scheme member, watch the video now and get prepared!

Watch the video now: https://youtu.be/5_nX3R6iu6I

Register now to join the eMPF introductory webinars:

https://www.manulife.com.hk/en/individual/products/mpf/empf-platform/empf-webinars.html

Visit Manulife eMPF Hub page: www.manulife.com.hk/empf-en

For enquiries about joining eMPF, don't hesitate to contact your MPF intermediary.

Remark: *The date of onboarding to eMPF is subject to a legal notice to be published in the Gazette of the Government of the Hong Kong Special Administrative Region. In case of a subsequent adjustment, we will promptly communicate this to you.

Maurice is a virtual avatar developed based on the likeness and voice of Maurice Aw-Yong, a real employee of Manulife.

Investment involves risks. Before making any investment choices, you should consider the scope and the service level offered by the scheme trustee and relevant service provider, whether fund choices are sufficient enough and suit your investment needs, and the related fees and charges. You should also consider your own risk tolerance level and financial circumstances. Investment loss or gain may be incurred when transferring accrued benefits to/from other provider(s). Please refer to the MPF Scheme Brochure and Key Scheme Information Document for details including risk factors, fees and charges of the scheme.

This video is the property of Manulife (International) Limited (“Manulife”). Unless otherwise indicated, the materials and information in this video may not be altered, reproduced, disseminated or distributed in any format without prior permission from Manulife. Manulife may change the content of this video from time to time without giving any prior notice. This video is for general reference only. It does not constitute an offer to see or a solicitation of an offer to buy any products or services from Manulife or any of its affiliated companies. This video is not intended to give any kind of financial, insurance, legal, accounting or taxation advice and shall not be based upon as any kind of such advice.

Issued by Manulife (International) Limited (Incorporated in Bermuda with limited)

My Favourite

My Favourite

Search

Search